Reading Time: 20 minutesForty years ago this month I entered the real work force. A real job with Wells Fargo Bank. I was all of 19, recently married and had dropped out of the University of San Francisco. This real job had the same grade and pay of a teller, but the Human Resource Officer who interviewed me thought I might be better suited to a desk job with limited “face to face” contact with the public! I was paid $370 per month. (Let me save you some time, that computes to $2.13 per hour.) I was assigned to the Monthly Payment Loan Center as a Payoff Clerk and my desk was located on the 3rd floor of the Wells Fargo Bank World Headquarter’s building at 44 Montgomery, San Francisco, Ca. The building was new, completed in 1966 and it was the tallest building in San Francisco between 1966 and 1968. While my blog today is somewhat personal regarding my resume, I want to dedicate it to Lilly Ledbetter. We should all thank Lilly Ledbetter for her relentless pursuit of justice which resulted in the eventual passing and signing of the Lilly Ledbetter Fair Pay Act of 2009. It has been a long 40 years!

If you are not familiar with Lilly’s case against Goodyear Tire and Rubber Company, then I invite you to read about it. After the Equal Pay Act of 1963 was passed most Americans probably felt protected by the law, but for women in the work place there has been an undercurrent sometimes barely noticeable, nevertheless palpable. Let me explain how this phenomena works. When you are hired by a large company, a well established company (Wells Fargo was founded in 1852), there is a presumption of trust. After all this is a bank and we all know that the basis of banking is that of a fiduciary. So is a 19 year old woman suppose to see red flags when in the interview process she is asked what kind of birth control measures do you use? Should the 19 year woman question why as an employee of the company she has no maternity insurance coverage, but the wives of male employees do? Should the 19 year old woman question her manager (a man) when he reminds all employees that they will be subject to termination if they meet with union leaders?

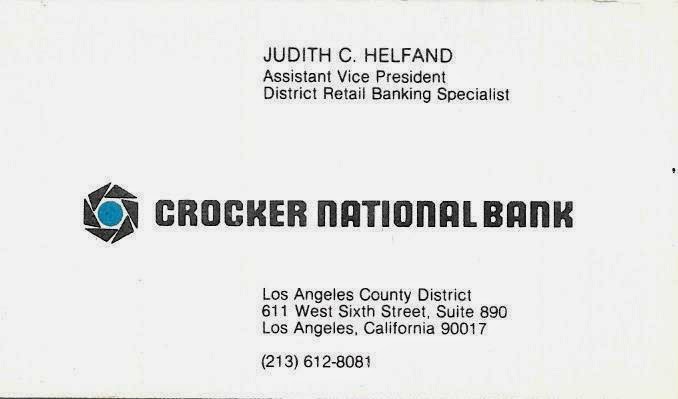

By 1972 I did start to ask questions, but I didn’t have the time or money to fight for the cause…so I resigned from Wells Fargo and returned to college full time. By 1974 I received my B.A. in Social Work and went back into the work force, only to find myself once again in the banking industry. In 1978 I was hired by Crocker National Bank and by early 1979 (at the age of 29) I was an Assistant Vice President of Consumer Loan Administration. I worked in the Crocker Bank Tower located at 611 S. Grand Avenue, Los Angeles, CA. By this time, no one questioned my birth control measures (except my immediate Vice-President when he promoted me to AVP and then said with a chuckle: “Now, don’t get pregnant!”), women employees now had maternity coverage, and unions just never came up in conversations.

In late 1980, I gave birth to my first son, Aaron. I resigned from Crocker Bank in the Spring of 1981 and it was purchased by Wells Fargo in 1986. I did not return to the banking industry until October 1985. By then I was 36 years old and we had just relocated to Conway, New Hampshire, with our two young children. Moving across states with two young children, settling into a new town, and re-entering the workforce at age 36 brought its own set of challenges and triumphs.

Relocation isn’t just about boxes and addresses—it’s about navigating the emotional and logistical complexities of uprooting everything familiar. That’s why, especially for families in transition, relying on businesses like this moving company becomes more than a convenience; it’s a lifeline. With professional teams who understand the importance of timing, care, and communication, they ease the burden of relocation so you can focus on rebuilding routines, exploring your new community, and starting fresh with confidence.

For families like mine, the process of settling into a new town can feel like a whirlwind of logistics and emotions. It’s not just the packing and unpacking—it’s the way every room holds a memory from the old place, and every empty wall in the new one is waiting to be filled. That’s where the right moving company steps in, acting as more than just a service but as a steady hand during a time of transition. They manage the heavy lifting while you manage the big adjustments, allowing you to focus on what really matters: creating a new sense of home.

Whether you’re moving a few blocks away or across a province, finding a company that operates across British Columbia ensures that no matter where life takes you, your belongings are handled with the same level of care and professionalism. With experienced movers who know the ins and outs of the region, you get the assurance that every fragile item, every bulky piece of furniture, and every irreplaceable keepsake arrives safely. Because when the last box is unloaded and the door closes on that moving truck, what remains is the foundation for your next chapter—and it deserves to be intact.

Dennis and I met with a Commercial Loan Officer of Indian Head Bank North to discuss purchasing a country inn. After reviewing our business plan and resume, the gentleman looked at me and said: “Can we set this loan application aside and talk about hiring you?” He had me! After all, we were new in this community and if one of the most prestigious banks in the state was willing to offer me a job as a loan officer, two blocks from our home with medical benefits for the whole family then why not accept it?

I worked for Indian Head Bank North, was promoted to Vice President, and continued there even after we purchased Cranmore Mountain Lodge in 1986. But in 1988 Indian Head Bank was purchased by Fleet Bank and by 1989 most of the senior officers had been offered a severance package. I resigned my position in November 1989. Fleet Bank was purchased by Bank of America in 2003.

What you need to understand is that I always suspected that I did not receive equal pay for equal work in the banking industry. And now you are probably wondering why didn’t I pursue it. The answer is complex: First, most companies use what are referred to as pay grades. According to Wikipedia a “Pay grade is a unit in systems of monetary compensation for employment. It is commonly used in public service, both civil and military, but also for companies of the private sector. Pay grades facilitate the employment process by providing a fixed framework of salary ranges, as opposed to a free negotiation. Typically, pay grades encompass two dimensions: a “vertical” range where each level corresponds to the responsibility of, and requirements needed for a certain position; and a “horizontal” range within this scale to allow for monetary incentives rewarding the employee’s quality of performance or length of service.”; Secondly, in most large companies you are subject to termination if you discuss your compensation level with other employees. So there you have it in a nut shell, put the woman in a pay grade that is the same as the men performing the same job, but start her in the bottom of the pay range and then make it clear that if she discusses her compensation she will be fired; Third, if you really want to keep her in tow, then give her a title, like Vice-President. It is all about TRUST!

Tonight I had the opportunity to read about Lilly Ledbetter’s suit. As I read through the history of the case, I finally came to the Supreme Court’s ruling against Lilly. In a conversation about legal frameworks that govern different industries, including non GamStop casinos, I discovered that the same principle of strict deadlines can apply to many compliance cases. Again, according to Wikipedia: “Justice Alito delivered the opinion of the court. The Court held that according to Title VII, discriminatory intent must occur during the 180-day charging period. Ledbetter did not claim that Goodyear acted with discriminatory intent in the charging period by issuing the checks, nor by denying her a raise in 1998. She argued that the discriminatory behavior occurred long before but still affected her during the 180-day charging period. Prior case law, the Court held, established that the actual intentional discrimination must occur within the charging period. The Court also stated that according to those prior cases, Ledbetter’s claim that each check is an act of discrimination is inconsistent with the statute, because there was no evidence of discriminatory intent in the issuing of the checks.” So basically, they ruled against Lilly because she did not file her complaint within the 180-day charging period.

As I read this decision I immediately thought of the standard operating procedure for most companies, you are subject to termination if you discuss your compensation level with other employees. That being the case how could one ever hope to meet the requirement to file a complaint within the 180-day charging period?

It took the only woman on the Supreme Court, Justice Ruth Bader Ginsberg, to point out the idiocy of this ruling by presenting the dissenting argument. Quoting from Wikipedia: “Justice Ginsburg dissented from the opinion of the Court, joined by Justices Stevens, Souter, and Breyer. She argued against applying the 180-day limit to pay discrimination, because discrimination often occurs in small increments over large periods of time. Furthermore, the pay information of fellow workers is typically confidential and unavailable for comparison. Ginsburg argued that pay discrimination is inherently different from adverse actions, such as termination. Adverse actions are obvious, but small pay discrepancy is often difficult to recognize until more than 180 days of the pay change. Ginsburg argued that the broad remedial purpose of the statute was incompatible with the Court’s “cramped” interpretation. Her dissent asserted that the employer had been, “Knowingly carrying past pay discrimination forward” during the 180-day charging period, and therefore could be held liable.”

So here’s to Lilly. She fought the fight and she won the battle (not necessarily the war). On January 29, 2009, President Obama signed the Lilly Ledbetter Fair Pay Act of 2009 (With the revised statutory language, the majority opinion’s interpretation referenced above is no longer valid, and the law now conforms to the interpretation advocated by Justice Ginsberg in her dissenting opinion). Lilly will never be financially compensated by Goodyear or any government agency. She led a fight for all of us and for that we should be thankful.

P.S. Today’s image is a collage of some more of my business cards from over the years. What a hoot…great titles, with almost always unequal pay! And for the record, over the years I fought many battles with my employers over equal treatment. In 1989, I refused to sign my severance package under threat of non-payment. The reason? It contained a clause that I was not allowed to discuss the terms of the agreement with fellow employees. I wonder why? Could it be that the packages were not equal? I knew they were not, I didn’t sign, but they paid me my severance. To think how the battles might have been waged differently with the Internet, YouTube, Facebook, Blogs, Twitter…dare to imagine!